After the marketization of the sanitation and cleaning industry under the PPP model, how can small and medium-sized sanitation vehicle companies overcome the market decline?

2022-08-29

In recent years, with the market-oriented operation of basic projects and the continuous promotion of the PPP model, government departments have shifted from being both referees and players in the sanitation cleaning market.

Large sanitation vehicle companies have successively established their own cleaning companies, adopting their own vehicles on a large scale, while small and medium-sized sanitation vehicle companies face increasing survival pressure due to various limitations such as scale and funding.

Small and medium-sized sanitation vehicle companies face enormous survival pressure.

After large sanitation vehicle companies secure cleaning projects through their own cleaning companies, all sanitation vehicles they can produce are made from their own products.

However, for the vast majority of small and medium-sized vehicle companies, although they belong to the same industry, the transition from focusing on manufacturing to exploring new sanitation service industries is limited by the company's energy and funds, making it difficult for most companies to adapt to this trend.

In contrast, sanitation vehicle companies in Europe and the United States, such as Johnston in the UK, Elgin in the US, and Faun in Germany, are leaders in the sanitation vehicle industry, but they have never ventured into the cleaning industry, instead focusing on their own fields.

Faced with the current situation, most small and medium-sized sanitation vehicle companies have clearly felt the chill, and under the trend of falling prices and volumes, everyone is thinking about how to break out of this predicament.

Reasons for the market decline of small and medium-sized sanitation vehicle companies.

In recent years, with strong promotion and support from the central government, the trend of market-oriented sanitation services has been fully rolled out across the country.

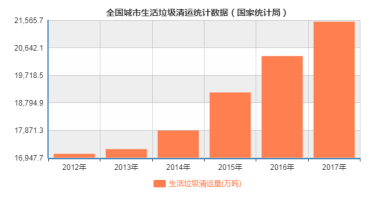

In the process of taking over sanitation services, the old equipment in the hands of the government is also required to be taken over by service companies through leasing or buyout. Therefore, based on market feedback over the past three years, the overall sanitation vehicle market has declined by about 25%.

In earlier years, during the marketization of sanitation, some small and medium-sized sanitation service companies held a large market share, but with the promotion of the PPP model in recent years and the push from some large sanitation service companies, small and medium-sized sanitation service companies are gradually exiting the market, and most of the enterprise clients of small specialized vehicle companies are these small sanitation service companies. As they shrink, the sales of small specialized vehicle companies have been severely impacted.

From the bidding situation of sanitation service projects across the country, local governments currently prefer to cooperate with large sanitation service companies, and the contract amounts for projects are getting larger, which directly leads to some small sanitation service companies being unable to even meet the bidding threshold.

These large sanitation service companies hold major projects, and the volume of equipment procurement is naturally significant. Sanitation service companies without manufacturing capabilities usually engage in strategic cooperation with certain large sanitation vehicle companies, but the most essential factor is still to purchase equipment through installment payments.

This is unbearable for most small specialized vehicle companies, as the prices and profits of small vehicle companies are already very low, making it impossible to bear the financial costs and accounts receivable risks generated by installment payments. Even for those large vehicle companies that engage in installment payments, issues with overdue accounts receivable frequently occur, and there are not a few cases that end up in court.

The manufacturing threshold for most sanitation specialized vehicles is relatively low. From the categories of commonly used sanitation specialized vehicles on the market, such as water trucks, self-loading garbage trucks, small box unloading garbage trucks, and closed garbage transfer vehicles, there is almost no technical threshold.

In such a serious situation of homogeneity, in order to survive, everyone can only engage in vicious price competition, and some even cut corners on the chassis and superstructure, passing off inferior products as good.

In recent years, the country has invested heavily in urban waste management and rural environmental remediation, and many companies have continuously entered the sanitation vehicle field, making an already competitive market even more challenging.

How small and medium-sized sanitation vehicle companies can respond to the current predicament.

1. Focus on the operating costs of products. With the change in the nature of end customers, cleaning service companies' clients pay more attention to price, operating, and maintenance costs. Therefore, companies should not only continuously improve product quality and reduce production costs but also fully consider the actual operating and maintenance costs of vehicles.

2. Expand the remanufacturing business of products. Due to the special use of sanitation vehicles, the superstructure is subject to long-term corrosion from garbage leachate, resulting in significantly higher wear compared to the chassis. For example, closed garbage transfer vehicles often show severe wear on the cargo compartment, making it unusable, while the chassis remains intact.

Since the cost of purchasing new equipment is much higher than that of maintenance, in general, customers in such cases directly seek external auto repair shops for simple repairs. However, the repair effect is often not as good as that of the original factory, so companies can specifically follow up with some of their existing customers to undertake remanufacturing business for related products.

3. Focus on core products. It is recommended that companies concentrate on a few advantageous products under the current situation, enhancing the sales of these products and reducing production costs. At the same time, when developing new products, conduct thorough market research and listen to user opinions and suggestions, avoiding blind development and hasty investments.

4. Reassess the company's market positioning. The market for sanitation vehicles is evolving, transitioning from the past single government procurement to the following categories:

1. Government procurement. 2. Procurement by large sanitation cleaning companies. 3. Procurement by small and medium-sized sanitation cleaning companies.

I believe that small and medium-sized sanitation cleaning companies will be the main target customers for small specialized sanitation vehicle companies. These customers are highly sensitive to price, primarily based on the characteristics of their cleaning service market.

Therefore, companies should develop products with better cost-performance ratios for these customers, which are more in line with the characteristics of small and medium-sized sanitation vehicle companies.

5. Explore overseas markets. There is a huge development gap among countries worldwide. From publicly available information and relevant customs data on China's export of sanitation products, South America, Africa, Western Europe, and Southeast Asia are currently the main export destinations for domestic sanitation vehicles.

I visited Southeast Asian countries in 2019, and most of the equipment they currently use is second-hand sanitation vehicles from Japan. Although they are second-hand, the prices are still relatively high.

These countries have lagging manufacturing industries, and their requirements for related sanitation vehicles are still about 15 years behind us. Compared to sanitation vehicles from Europe, the US, and Japan, domestic products have a significant competitive advantage.

6. Focus on improving and accumulating product technology. Most small and medium-sized sanitation vehicle companies primarily focus on marketing, with the energy of company leaders mostly concentrated on market development. Attention to product technology often only occurs after problems arise with sold products.

In contrast, their counterparts in Europe and the US may not be large in scale, but they place far greater emphasis on technology than we do.

Although small and medium-sized enterprises do not have strong financial resources to delve deeply into technology, if they can invest a little more in technology within their means, it is believed that it will bring unexpected surprises to the enterprise.

Source: Special Vehicle Magazine

Other Services

2023-03-22

Video

Video Recruitment

Recruitment Environmental services

Environmental services 400-0525-925

400-0525-925

400-0525-925

400-0525-925 marketing@jlhoe.com

marketing@jlhoe.com 皖ICP备17015054号-1

皖ICP备17015054号-1